Think of health insurance as something that is there to help protect your health and your budget. It covers expenses you incur from dental care as well as illness and accident costs that are not covered by your provincial or territorial health insurance. In a nutshell, supplemental health insurance plans offer an enhanced level of protection to ward off financial difficulties at vulnerable times.

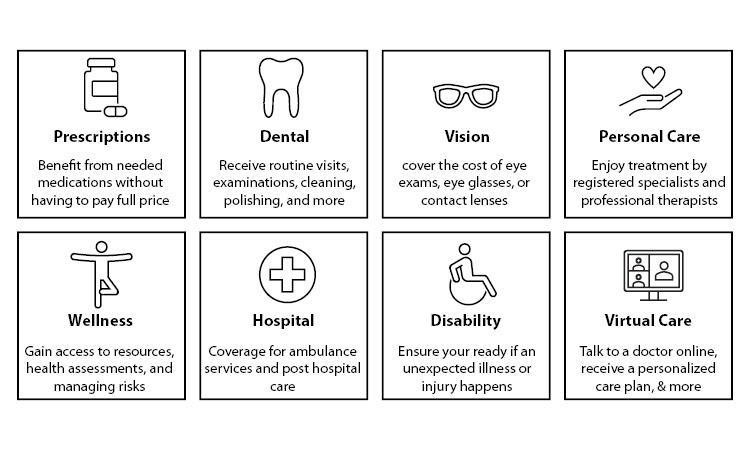

What’s covered under health and dental plans?

If you are a gig worker, freelancer, or self-employed (as approximately one in three Canadians are nowadays) you might need supplemental insurance. Your particular needs and circumstances, as well as your budget, will help determine the type and amount of coverage that is right for you. You can find flexible options that allow you to completely tailor health insurance to your and/or families needs. They are easy to buy and easy to manage, and best of all easy to understand.

A wide array of expenses can be covered under health and dental insurance. These include such things as:

- Prescription drugs to treat a health condition

- Dental treatments such as teeth cleanings, x-rays, braces, dentures, and crowns

- Vision-care needs such as eye exams, prescription glasses, contact lenses, and laser eye surgery

- Extended health care, including registered specialists and therapists (such as massage therapists, chiropractors, physiotherapists and psychologists), orthotics, hearing aids, homecare, and medical equipment

- Travel which helps cover the costs of emergency medical care for a predetermined number of days when travelling outside your home province or territory

You can pick a health and dental plan that’s the best for you

You can tailor your coverage to suit your needs and your budget. For example, you may need coverage for drugs but not dental work, or dental but not drugs — or you may need a plan that covers both. Typically, insurance companies will offer multiple types of coverage bundled as a single plan.

Health insurance comes with other services, too

Many health policies provide more than just coverage, there are also non-insurance perks, too. You can get telephone or virtual health care services, for example, that provide round-the-clock, on-demand access to medical professionals who can provide such services as prescriptions, mental health care, diagnoses, and referrals.

Additionally, several insurers are now offering wellness programs along with their insurance plans which can help put you and your family on a healthier path and provide you with discounts, rewards, and gift cards.

Who can be covered under your plan?

You, your spouse or partner and children may also be eligible for coverage under your insurance policy. As well, children between 19-25 who are still in school or are disabled may be eligible for coverage under your policy.

Why do you need personal health insurance if you have provincial healthcare?

Provincial and territorial health and drug plans in Canada provide coverage for certain health expenses. But there are gaps that can leave you with costly medical bills. If you were to get sick or injured, your government health plan may only cover a fraction of your medical bills. In some cases, you may not get any coverage at all. This means you could be left paying out-of-pocket to cover various health-care costs.

With personal health insurance, you will get reimbursed for eligible health expenses.

Tips for choosing the right health and dental plan

When determining what the best coverage is for you, you will want to consider a few things, such as:

- Your medical history and any pre-existing conditions – these might make you need higher prescription or hospitalization coverage or opt for a plan that doesn’t require a medical questionnaire.

- Your age – if you are an older individual, you might want coverage for home care or nursing care.

- The needs of your dependents – your children might need vision care or orthodontic treatment that you might want to account for in your plan.

You will need to balance your needs with your budget too. Look at such things as the percentage of health and dental expenses that are covered and the size of the deductible (which is the amount you pay out of pocket before the insurance kicks in) vs the amount of coverage you want/need.

Life is full of ups and downs, so it is important to note that if your circumstances change you can adjust your coverage on your policy. Want to increase your coverage on an existing policy? That can be done with updated medical information). Want to reduce your coverage (if you have been covered under the existing benefits for at least 12 consecutive months), that is easy to do too. If you experience big life changes such as getting married or having a baby, you can just as easily add your spouse or baby to your coverage.

Understanding your policy

It is important to read and understand your policy and schedule of benefits so you are aware of what is covered, what is not as well as the coverage limits. Once you have maxed out your annual coverage limit for an expense, you must pay out of pocket until the next year. And some expenses are subject to lifetime maximums, which are maximum dollar amounts your insurance company would pay out over your lifetime for non-essential health care such as orthodontics or fertility treatments.

Keep in mind that the year for many benefits is the anniversary year of the policy, not a calendar year – so if you signed up for your policy in March, your benefits run for a year until the next March. That’s important to remember so that you can get the most out of your health insurance, especially benefits for preventive health care. Set reminders to book appointments for your doctor and dentist regularly, and make time to see your massage therapist, chiropractor or other health service providers. Consider enrolling in wellness programs and save time and hassle by using virtual health services.

Also important to understand is what happens when there are multiple policies. For example, some of your expenses could be covered through other sources such as another health insurance policy, your spouse’s policy or credit card insurance. In this case, the amount of the eligible expenses covered by the province or territory will be paid first, and payment of the remaining eligible expenses will be coordinated between the other insurers. Your policy will outline how that works – sometimes one insurer will pay the full amount and sometimes it will be split between your insurers.

Did you know….

Did you know that the premiums for your personal health plan are eligible for medical expenses under the Canadian Federal Income Tax Act?

How to make a claim

In many cases your pharmacist, dentist, or health-care provider will submit your claim for you directly, meaning you don’t have to do anything. Otherwise, you can be reimbursed for the expense (if you submit your claim within 12 months of the date of the expense) via online, an app that many providers have, or by mail.

Ready to get a quote? Here’s how.

We are independent so we can shop the market unbiasedly for the best product for your needs. We have access to all the major companies such as:

Manulife, Canada Life, Sun Life, Green Shield, AB Blue Cross, and GMS

Simply, send us an email or give us a call and we can provide you with a side-by-side comparison of the options, making it easier to understand and make a decision. We will be here to support you.