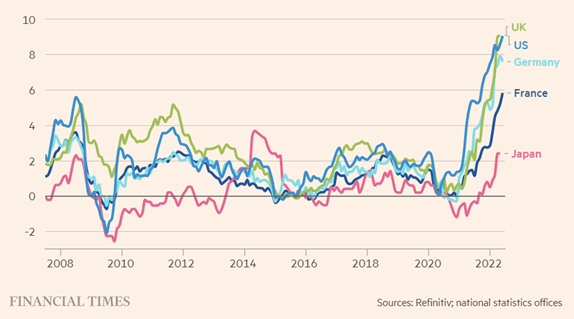

Well, it has been tough for the investment landscape this year and the Bank of Canada, determined to choke off rapid inflation before it becomes a permanent feature of the Canadian economy, is steering toward another three-quarter-point interest rate even as the economy shows early signs of slowing and recession fears mount. Getting inflation under control is the focus of global central bank policy but they also want to make sure they create enough room now so that if they need to interest cut rates later, they can. This is vitally important if we dip into a recession (which can potentially happen in 2023).

It is important to note that it isn’t just Canada, countries around the world are seeing inflation soaring and Federal policy makers are also adjusting their interest rates to help combat it.

The increase in interest rates has a negative impact on those carrying debt such as mortgages or businesses with loans, it does however, create an opportunity that hasn’t been seen in over a decade … bonds.

The window of opportunity for bonds

The path to higher interest rates is painful but it should ultimately benefit bond investors over the long haul. The recent downward selling pressure has brought bond valuations to an attractive entry point.

Bond yields look more attractive to investors now compared to earlier this year when they were much lower. Investors are getting paid much more than they were just a short time ago for buying bonds. The recent rise in interest rates creates a more favorable environment in the bond market and we believe that bonds offer compelling defensive characteristics relative to stocks.

There is a window of opportunity to build low-risk bonds into your portfolio, specifically in what we call ladders (staggered maturities). At the moment, the ability to bargain shop for high-quality bonds and their respective higher yields is ideal. Credit quality for most investment-grade issuers remains high and risks of default are low, but prices have been pushed down by anxiety-driven selling.

As the economy slows and potentially goes into a recession, the demand for these same bonds will increases as investors flee to portfolio safety and the price to buy them will go up, removing this window of opportunity to buy them at these low prices.

The primary opportunities for bondholders in today’s environment are in higher-quality securities, including Treasury bonds and investment-grade corporate bonds. This is a period when investors are likely to benefit from holding more high-quality assets and fewer volatile assets.

Important to note

First off, when we discuss bonds, we are talking about pure bonds, not bond funds. Bond funds often are a mix of bonds and other investment strategies within creating a hybrid type of investment that can often have more characteristics to equity rather than a pure bond.

When building a portfolio, it is important to remember that there are only two ways that one can increase the overall return from the bond sleeve. You can either extend the duration (hold longer term maturities) of the bonds, also known as the term premium, or one can reduce their quality, known as the credit premium (hold lower credit quality). Both actions, extending the term and lowering the quality, result in a higher yield fixed income portfolio. However, there are risks that come with following either of these strategies as well.

How to invest when interest rates rise

The answer to how you should be investing when interest rates rise is simple: you should invest the same way you should always be investing. That means building a diversified portfolio made up of quality equities, bonds, cash, and cash equivalents that will pay dividends through the ups and downs of the markets and the global economy at large.

Trying to time the market or predict which way rates will go is a wasted effort, for the smartest thing investors can do is mindfully manage their portfolios to limit the downside and increase potential upside as interest rates and the market fluctuate. Diversification is the best way to do that regardless of where rates are headed in the short or long term. So, while one may “lose” some money in the short-term, you need to be patient and stick with your investment plan. With diversification into things such as true bonds and a steady approach one can come out ahead. Be patient, it takes time and things will turn around.

Talk to your wealth professional for more information about how to position fixed income investments as part of a diversified portfolio.