Parents and other relatives frequently use in-trust accounts to save money for a child that will be given to them when they reach the age of majority. These trusts are a convenient way for parents and grandparents to set aside funds for minor children, allowing the account holder to make investment decisions on behalf of minor beneficiaries and potentially split income for tax purposes.

Essentially, an in-trust account is an investment account or a bank account that is held “in-trust” until the child reaches the age of majority. These accounts have gained popularity as an easy and inexpensive way to set up a trust. They can also be called an ‘informal trust’, as they do not require formal documentation or the use of a lawyer.

Formal vs Informal Trusts (In-trust for accounts)

Both a formal and In-trust accounts have the three same participants:

- Contributor—usually the adult(s) making a gift or contributing assets to a minor child. In a formal trust, this individual would be called the settlor.

- Beneficiary—the individual who benefits from account assets. This is usually a minor child related to the contributor. The beneficiary, not the contributor or trustee, is always the ultimate owner of the assets.

- Trustee—the ITF account holder on behalf of the minor beneficiary until age of majority is reached. In a formal trust, the trustee oversees all trust account activity and is responsible for trust tax reporting. The trustee can hold the assets on behalf of a beneficiary for any period of time as stipulated by the settlor (e.g., lifetime of the beneficiary).

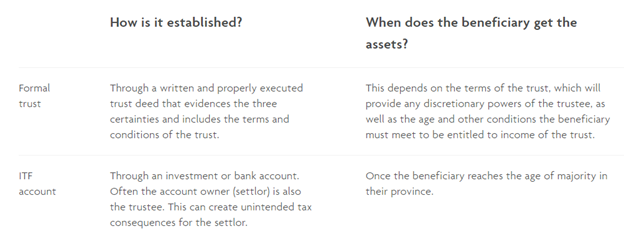

| How is it established? | When does the beneficiary get the assets? | |

| Formal Trust | A formal trust agreement or deed is typically drafted by a lawyer and identifies the settlor, the trust property, the trustees, and the beneficiaries. | This is defined by the terms of the trust. |

| ITF Trust | This is done though an investment advisor and does not require formal trust documentation. | Once the beneficiary reaches the age of majority in their province of residence. |

What you need to know about an In-trust for Account

Because this type of trust account is easy to set up, it doesn’t mean that there are always straight forward and there can be financial risk if not structured properly.

Ownership. Once you put money into an in-trust account, the money belongs to the beneficiary (child). This gift is permanent – there are no exceptions. The whole idea of a trust account is that the money belongs to someone who has rights to the money but is not given the authority to manage it. We’ve seen many instances where this fact is not understood. Some donors think they can take back the money whenever they need it. Legally, they cannot do so.

Taxes. When it comes to interest and dividend income, the tax on the income is attributed back to the donor. In other words, the donor has to report any interest or dividend income on their tax return. The only income that is not attributed back to the donor is capital gains. There are some exceptions. If the assets in the ITF account are provided solely from Child Tax Benefit payments, an inheritance or allowance, all income would be attributed and taxable to the beneficiary, and not the trustee.

The use of corporate class mutual funds is an excellent opportunity to reduce the taxation to the contributor and grow the value of investments for the future of the minor beneficiary.

Investment Control. The beneficiary (your child or grandchild) takes control of the funds at the age of majority, which is either 18 or 19 depending on the province you reside in. In other words, they can do whatever they want with the money. If they want to use the money in ways you don’t approve of, tough luck! The child can take legal action if you decline to give them access to the funds at the age of majority. With a formal trust, the donor defines the age of transfer and control.

Death. If the child (beneficiary) dies before he or she reaches the age of majority, the funds in the trust belong to the child’s estate. Because minors are not legally entitled to draft a Will, most minors will die without a Will and the child’s estate will be distributed according to provincial laws of intestacy. The donor cannot decide who gets the funds in an in-trust account if the beneficiary dies.

If the contributor dies before the beneficiary reaches the age of majority then, going forward, all future income earned from the funds in the account will be taxed in the child’s hands.

If the trustee dies before the beneficiary reaches the age of majority, then the trustee’s will should be consulted to determine if an alternate trustee is named. If not, the trustee’s authority over the account will remain with the trustee’s estate until the beneficiary reaches the age of majority (at which time the beneficiary is granted authority over the account).

Important to note – Documentation

Due to the ease and lack of need for formal documentation with an ITF, this in itself, is one of the biggest risks to having one. Besides the account opening documentation that is required by the investment institution/bank, it is often assumed that nothing else is required.

When someone opens an in-trust account, in the eyes of the Canada Revenue Agency (CRA), it is not always guaranteed that it will be seen a trust – it depends on your supporting documentation. To avoid the risk that the CRA will not interpret the ITF account as a trust, it would be prudent to create some sort of written document that clearly sets out the intention to permanently transfer assets and funds to this account for the benefit of the beneficiary. Three key points to outline in this document are:

- definition around key issues such as how the funds should be managed

- how long the trust will continue

- how assets can be distributed to the beneficiary

It would also be prudent to keep meticulous records regarding where the funds of the account are coming from for tax purposes.

Alternatives to an ITF include an RESP, paying for certain expenses for the child, or setting up a formal trust and using a prescribed rate loan strategy to avoid attribution rules while the beneficiaries are minors. Whether an ITF account is the best alternative depends on the family’s resources and goals. It is best to talk to an investment advisor to find out what is the best strategy for you.