After several weeks of escalating tensions, on February 21, 2022 Russia announced that it would recognize two pro-Moscow areas of Ukraine – Donetsk and Lukansk – as independent states [1]. Russia then quickly moved troops into these two areas. Investors, understandably, may be wondering how markets could react to further military escalation.

Recent developments

Many countries have responded to Russia’s recent actions with sanctions. Germany notably announced it would block the Nord Stream 2 pipeline, designed to deliver natural gas from Russia to the rest of Europe. The pipeline had been completed and was awaiting German approval to begin operating. Other NATO members – including Canada, the U.S. and the UK – announced financial restrictions.

Questions now remain around Russia’s next moves and how countries will continue to respond. Putin’s speech on February 21st suggested he’s questioning Ukraine’s sovereignty; however, uncertainty remains around whether he is planning a full-scale invasion or will stop at moving into these two regions that have close ties with Russia.

How markets respond to acts of war.

While market uncertainty may persist for some time, there are two important messages investors should keep in mind:

- Acts of war rarely have large or lasting impacts on markets.

- Periods of heightened uncertainty are common during times of geopolitical tension.

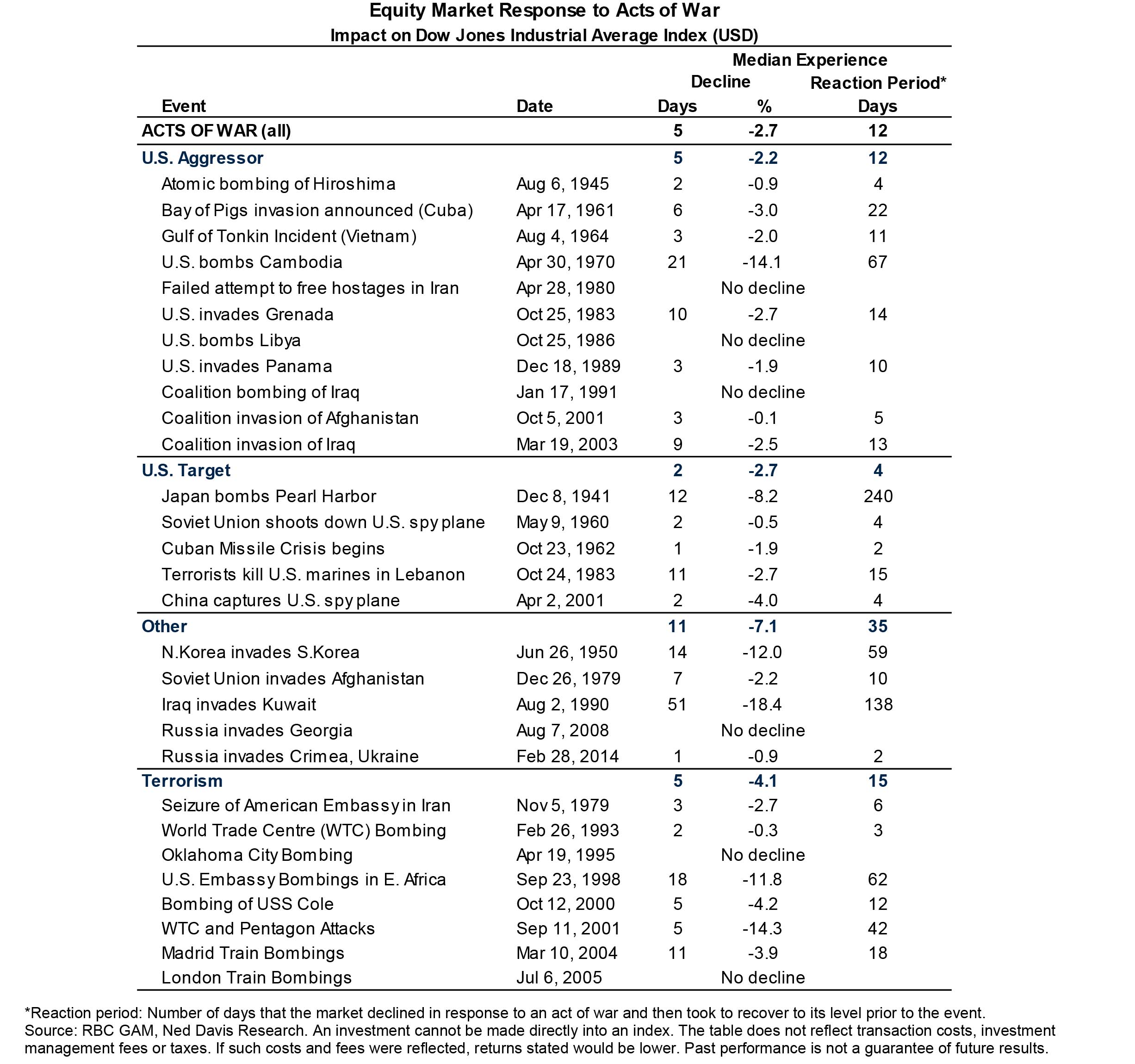

A strong investment plan is designed to withstand periods of volatility so investors don’t have to react. With that in mind, let’s look at some evidence that shows how markets typically respond to acts of war. The chart on the next page looks at how U.S. equity markets have historically reacted in response to acts of war and terrorism.

What you’ll notice is that market declines tend to be short. They typically last 5-11 days, depending on the situation. The actual change in the market is also relatively benign, and often more muted than what investors might think. In fact, historically they’ve been more muted than the decline U.S. equity markets experienced in January of this year.

Of course, no one can predict with certainty how financial markets will react during a war or other conflict. However, one thing is clear: having a long-term view is likely your best ally in times of crisis.

[1] https://www.nytimes.com/live/2022/02/21/world/ukraine-russia-putin-biden